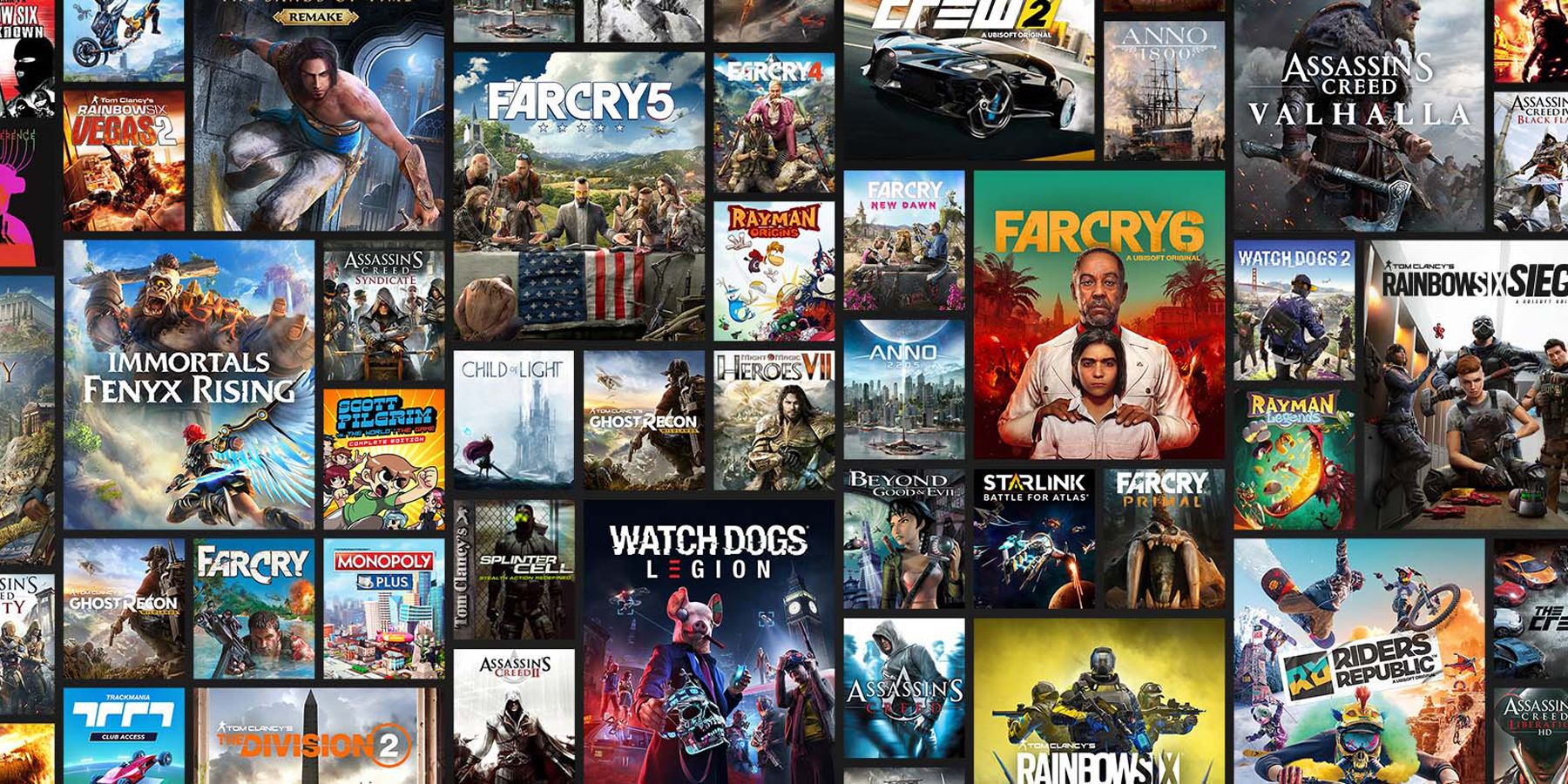

Chinese game company Tencent has made headlines over the last few years for its aggressive expansion into the international market. It’s acquired shares in several game developers and publishers in the US and Europe, including a 5% stake in Assassin’s Creed and Skull and Bones publisher Ubisoft.

However, it seems that Tencent is no longer satisfied with its small slice of the French corporation. The Chinese gaming giant is reportedly hoping to increase its ownership of Ubisoft with the long-term goal of becoming the company’s largest single shareholder.

According to Reuters, four anonymous sources recently came forward with information on the deal in progress. According to them, Tencent is in negotiations with Ubisoft’s founding Guillemot family, who own 15% of the company. Tencent is reportedly offering 100 euros ($101.84) per share, compared to the 66 euros ($67.59) per share they spent in 2018 to acquire their current 5% stake in Ubisoft. Tencent’s also attempting to acquire additional stocks from private shareholders, who own a combined 80% of Ubisoft’s shares.

According to a source close to the negotiations, Tencent and the Guillemots have yet to finalize their deal, which may be subject to change. It’s also unclear how many shares Tencent is offering to buy or what percentage of Ubisoft’s stock the company hopes to acquire overall. Neither Tencent nor Ubisoft were willing to answer questions about the deal, and Reuters could not reach the Guillemots for questions. However, a source noted that Tencent is offering well above Ubisoft’s current stock prices to prevent competition. In addition, Tencent senior executives reportedly flew to France to discuss the purchase with the Guillemot family, who have opposed previous Ubisoft buyout attempts.

Two of Reuters’ sources also noted that the aggressive offer is part of Tencent’s initiative to acquire quality independent game studios. The company acquired a majority share of Clash of Clans developer Supercell for $8.6 billion in 2016, owns 9% of Elite Dangerous developer Frontier Developments, and has stakes in US video game developers Epic Games and Riot Games. Tencent also plans to buy Crackdown 3 developer Sumo Digital for a reported $1.3 billion.

Tencent’s overseas expansion may be partially motivated by domestic pressures. Tencent’s revenue from China fell by 1% last quarter while seeing a 4% increase in international revenue. The company is also struggling with Chinese regulators, who put a freeze on new game licenses last year. Even with the moratorium ending in April, the Chinese government has still yet to grant Tencent any new licenses. In that context, it’s not entirely surprising that Tencent may want to broaden its horizons.

Source: Reuters